*Disclaimer: The article is the opinion of Michael Ballanger and not of Streetwise Reports. Topics discussed may be controversial to some readers.*

This newsletter always comes out with the title "Summer Doldrums" after the Canada Day holiday for a number of reasons, but the main one does not apply to the weather; it applies to my inability to find anything interesting (or witty) about which to write.

In any given week, I find myself scouring the internet for topics relevant to my security holdings that either fortify (hurrah!) my bullish thesis or refute it (God forbid!), with my preference being obviously the former while loathing the latter. I must admit that it is getting more and more difficult to generate self-excitement (intellectual, of course) when it comes to topics that, a mere three years ago, were all I could talk about.

A great example is the theme of The 2020 GGMA Forecast Issue, where I wrote about sovereign debt levels around the world and how all that debt needed to be collateralized by something other than "veiled promises." I suggested that since gold was the only collateral in existence that could provide an underpinning to unbridled credit creation, and a mere two months after I penned that issue, COVID-19 arrived on a silver platter for the money lords giving them the perfect cover for the largest can-kicking orgy in modern history.

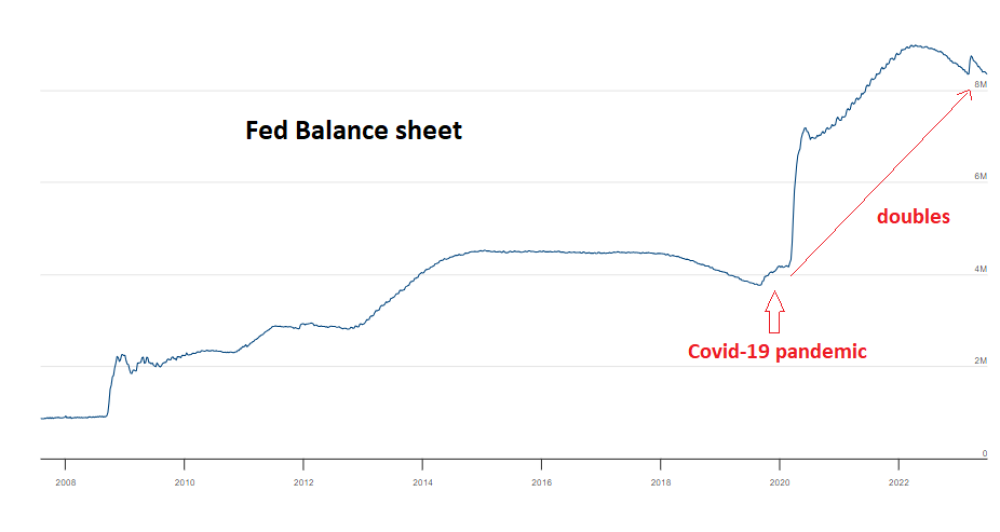

With nary a shred of science confirming the need for anything other than temperance, the world's central banks went on a panic-binge of fiscal insanity, dropping trillion of dollars from helicopters while those in charge of monetary policy, the central bankers, conjured up trillions of dollars in new credit, with the U.S. Fed's balance sheet exploding from under US$4 trillion to over US$8 trillion in two years.

Pandemic Savings Exhausted

We tend to forget about narratives that affected us deeply, but we can all remember the sight of federal and state/provincial masked politicians standing in front of cameras with scientists at their side spouting off orders to the populace that prevented children from visiting ailing parents affected by the virus or kids from playing in a schoolyard. I watched the pundits' angle and position for maximum voter approval by using people decades removed from the medical or research fields as sentiment shields from mass criticism.

They instigated panic at every turn, using hired quacks as "experts," shutting down the global economy and providing the bankers the cover for a massive money-drop directly and indirectly into the pocketbooks of the drug companies and their lobbyists.

I still get heated over the vaccine narrative of 2020-2022, where I could not even discuss it with my family for fear of massive retribution. My daughter was screaming at me to get myself "vaxed" because, at my age, I was in the high-risk camp.

At the time, I explained to my daughter that there was (and is) only one entity that has earned the right to tell me what to do with a viral threat, and that lady has been around for millions of years.

Her name is Mother Nature, and she bestowed upon humans a wonderful gift that we have used efficiently for the Millennia, and it is called the "immune system." Notwithstanding the existence of citizens whose immune systems were compromised by substance abuse or genetic defect, here we are three years-plus after the arrival of that pandemic, and we still have people wandering around in the park on a sunny day wearing surgical masks and avoiding everyone.

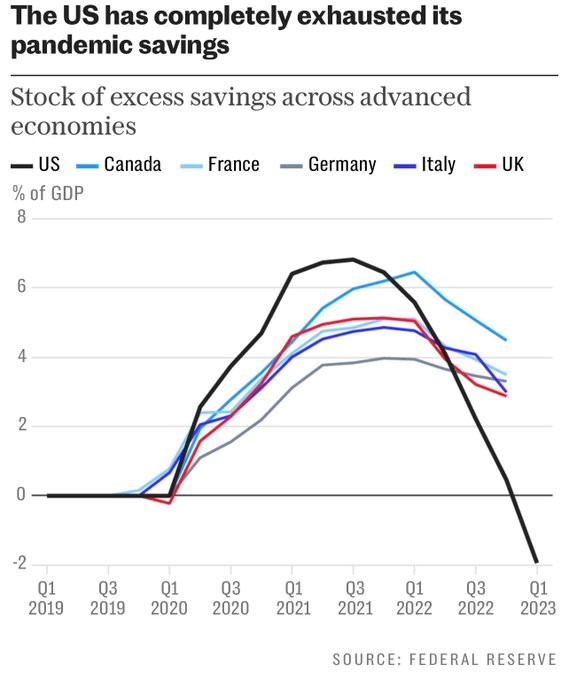

The trillions of dollars handed to the U.S. electorate by politicians concerned with re-election over legacy management wound up in the coffers of the masses resulting in an explosion in living costs and an explosion in cash balances. This unprecedented airdrop of freshly-inked cash has been lingering around for over three years resulting in "sticky" inflation rates and a surprisingly strong economy, but that is all coming to a resounding end. As this chart reveals, the government handouts are rapidly dwindling away and will soon result in a vapourization of consumer spending which will stunt demand growth in the same way the 2020 lockdown stunted supply chains.

The "doldrums" were first encountered by sailors crossing the Atlantic, usually in an area off the midwestern coast of Africa where the westerly trade winds stopped blowing, leaving the ships adrift and without power or direction. It was a terrifying experience for sailors to watch food and water rations slowly deplete while captains stared off into the horizon for evidence of a whiff of breeze that could end the misery. I fear that the world is about to enter an economic Intertropical Convergence Zone where the winds of trade and commerce have gone "dead still."

Inflation and Global Deflation

If I am right, concerns about accelerating inflation will be replaced with concerns about global deflation, as opposed to "disinflation." If there is one condition that the banks fear, it is deflation.

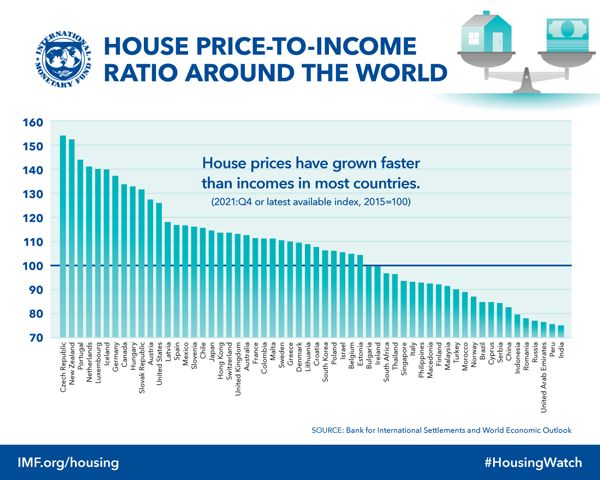

While disinflation refers to a moderation in the trend of price increases, deflation refers to a drop in actual prices paid, and when bankers look at their loan books, drops in the value of goods sold are drops in the value of the collateral backing their loans. This is what the bankers like Jerome Powell saw in 2020 and what Hank Paulson saw in 2008, just before they opened up the money-printing spigots. In 2008, the vapourization of bank balance sheets through toxic loan exposure was the trigger; in 2020, it was the fear of a deflationary collapse after the global lockdown occurred.

These triggers are so very transparent when one tries, as I do, to understand the logic of moves by the sovereign governments and their lapdog central bankers. As my mentor, the late and venerable Richard Russell ("Dow Theory Letters") would always write: "Follow the Money" and in the search for a substantive rationale upon which to hang one's explanation of such aberrant fiscal behaviors around the world, following the money trail really is a search for who is the most-exposed to a deflationary collapse and the answer, as always, reverts back to those that printed the money and created the debt and that is governments and central banks.

The bogeyman in the 2023 room is now Commercial Real Estate, where defaults are occurring weekly in urban centers where occupancy rates have tumbled. The "Work-From-Home" initiative that originated as a response to the global economic shutdown is now an albatross for managers the world over as they try in vain to coax their employees back to a daily commute of traffic jams, smog, day-care expenses, and water-cooler office politics.

Now that the second quarter of 2023 is underway, the pundits will be sword-fighting in the arena of economic relevancy on whether or not the world is in for a soft or hard landing as to the eventual impact of these record rate increases. I cannot turn on a financial news channel where some "contributor," be it CNBC or BNN or Fox News, does his-her best to out-scream the moderator in calling for "NO RECESSION!" as he/she sneaks a peak at the ticker tape to try to see where her 500 shares of Nvidia just traded.

I see an egregiously-overbought NASDAQ and a mildly overbought S&P500 inspiring huge leaps in investor sentiment while the TSX Venture, a proxy for junior commodity plays, as the most oversold and unloved since late 2015 with sentiment readings not just "down" but in many cases off the board and invisible.

As for me, I see an egregiously-overbought NASDAQ and a mildly overbought S&P500 inspiring huge leaps in investor sentiment while the TSX Venture, a proxy for junior commodity plays, as the most oversold and unloved since late 2015 with sentiment readings not just "down" but in many cases off the board and invisible.

The difference this time is that when sentiment is low, there is usually a reflexive bounce-back that can be traded, but when there exists total apathy toward any asset class, there is no bounce whatsoever.

Forgive the crudeness, but an old E.F. Hutton sales trainer once told our class, "The reason you need to have your clients own blue-chips instead of speculative S**T is that quality issues always bounce, but in a crash, S**T don't bounce!"

That is today, the lot of the junior gold and junior silver "darlings" that are always being advertised on BNN and in the chatrooms and blogs, and gold websites. The majority of investors are avoiding them because while they are viewed as being "cheap," the consensus opinion is that they are doomed to remain cheap. And therein lies the problem.

I own a number of these "penny dreadfuls" in the precious metals (and copper) space, and I am not alone when I say that sentiment is at a generational low right now. Battery metals, including lithium and nickel, have maintained a modicum of interest, but there are tons of junior developers with respectable mineable resources of gold or silver that cannot raise a dime even with the help of Ghislaine Maxwell.

If one's argument is that valuation is considered "compelling," the counter-argument is "What will change that?" and that is where I am stuck right now, like one of those equator-bound, eighteenth-century Tall Ships that have lost the wind and are roasting in the noon sun with nary a breeze to be found.

It is no small irony that most big polymetallic deposits have both silver and lead as major byproducts of the primary metal. I own silver as a replacement for currency with the knowledge that behind each of those currency units in circulation, there lies an absolute mountain of debt.

How many times have we all read a blog or watched an ad on BNN where silver is recommended as a "safe haven," "portfolio insurance," or "a prudent alternative" to stocks or bonds?

Answer?

NEVER. Unfortunately, silver is indeed the "poor man's gold," but it is always without fail "going to US$100" followed by ten exclamation marks. "US$200 by Christmas!" or "Buy it now! Before the world ends!" or the most famous falsehood ever jammed down the throats of the naïve retail investor "SILVER SHORTAGE LOOMS!!!!"

Silver

As a result, since the Great Financial Bailout Crisis of 2008, the Millennials and the Genexers have been flummoxed to within an inch of their lives by listening to the malarkey spread by the silver bulls. Make no mistake; I love silver. I own a bunch of those beautiful 99% pure 100-ounce bars and would not trade them for the world.

I have owned a boatload of shares in a junior silver deal since 2019 and am seriously underwater. However, I did not but my bars or my shares out of fear or greed; I bought silver because in 2011, U.S. national debt was under US$15 trillion, and silver hit US$50. Today with the national debt at over double that to nearly US$32 trillion, silver is under US$25. Likewise, in 2011, the Fed's balance sheet was a tad over US$2 trillion; today, it is approaching US$8.4 trillion.

Why would I not want to own silver here?

Norm Franz once wrote that "silver is the money of gentlemen," but what is most important in Franz's famous quote is the last line and which is "Debt is the money of slaves," and as true as that is in the socioeconomic mix, a fifth line is soon to be added in light of the widening equality gap creating widespread riots in Paris recently, and that is "lead (as in bullets) is the money of the oppressed."

It is no small irony that most big polymetallic deposits have both silver and lead as major byproducts of the primary metal. I own silver as a replacement for currency with the knowledge that behind each of those currency units in circulation, there lies an absolute mountain of debt.

| Want to be the first to know about interesting Special Situations and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.